Frost Pllc Fundamentals Explained

Table of ContentsOur Frost Pllc IdeasLittle Known Questions About Frost Pllc.The smart Trick of Frost Pllc That Nobody is DiscussingFrost Pllc Fundamentals ExplainedSome Known Questions About Frost Pllc.

Certified public accountants are amongst the most trusted careers, and completely factor. Not only do CPAs bring an unparalleled level of understanding, experience and education and learning to the process of tax obligation planning and managing your money, they are especially trained to be independent and unbiased in their job. A certified public accountant will certainly aid you secure your interests, pay attention to and resolve your problems and, just as crucial, provide you assurance.In these defining moments, a certified public accountant can provide more than a basic accountant. They're your relied on expert, guaranteeing your company remains monetarily healthy and balanced and legally protected. Employing a regional certified public accountant firm can positively impact your organization's monetary health and success. Below are five vital advantages. A regional certified public accountant firm can help in reducing your service's tax concern while guaranteeing compliance with all applicable tax obligation laws.

This growth shows our commitment to making a favorable effect in the lives of our clients. Our commitment to quality has been identified with several honors, including being called among the 3 Best Audit Firms in Salt Lake City, UT, and Best in Northern Utah 2024. When you deal with CMP, you enter into our family members.

Top Guidelines Of Frost Pllc

Jenifer Ogzewalla I have actually functioned with CMP for numerous years currently, and I've actually valued their knowledge and effectiveness. When bookkeeping, they work around my timetable, and do all they can to preserve connection of employees on our audit.

Right here are some key inquiries to direct your choice: Inspect if the certified public accountant holds an energetic certificate. This guarantees that they have actually passed the essential exams and satisfy high moral and expert standards, and it reveals that they have the certifications to handle your financial matters responsibly. Confirm if the CPA uses services that line up with your organization requirements.

Small companies have one-of-a-kind monetary needs, and a CPA with relevant experience can supply even more customized recommendations. Ask concerning their experience in your sector or with services of your size to ensure they comprehend your particular obstacles. Understand exactly how they bill for their services. Whether it's hourly, flat-rate, or project-based, recognizing this upfront will certainly stay clear of surprises and verify that their services fit within your spending plan.

Clear up exactly how and when you can reach them, and if they offer routine updates or assessments. An easily accessible and responsive certified public accountant will be vital for timely decision-making and support. Working with a local certified public accountant company is greater than just contracting out financial tasksit's a wise financial investment in your company's future. At CMP, with workplaces in Salt Lake City, Logan, and St.

How Frost Pllc can Save You Time, Stress, and Money.

An accounting professional who has passed the certified public accountant examination can represent you before the internal revenue service. CPAs are licensed, accounting experts. CPAs may function for themselves or as get more part of a firm, depending upon the setup. The cost of tax obligation preparation may be reduced for independent specialists, however their know-how and capacity may be much less.

Not known Details About Frost Pllc

Taking on this obligation can be an overwhelming task, and doing something wrong can cost you both financially and reputationally (Frost PLLC). Full-service certified public accountant firms are acquainted with declaring needs to guarantee your service follow government and state laws, in addition to those of banks, capitalists, and others. You may need to report added income, which might require you to file a tax obligation return for the initial time

group you can rely on. Get in touch with us to find out more about our solutions. Do you understand the accounting cycle and the steps included in making certain appropriate financial oversight of your organization's monetary well-being? What is your company 's legal framework? Sole proprietorships, C-corps, S firms and collaborations are strained in a different way. The even more facility your revenue resources, places(interstate or worldwide versus local )and market, the a lot more you'll require a CPA. CPAs have a lot more education and go through a strenuous accreditation process, so they cost even more than a tax preparer or bookkeeper. Typically, little companies pay in between$1,000 and $1,500 to work with a CERTIFIED PUBLIC ACCOUNTANT. When margins are tight, this cost may beout of reach. The months gross day, April 15, are the busiest time of year for Certified public accountants, adhered to by the months before the end of the year. You may have to wait to obtain your inquiries answered, and your tax return might take longer to finish. There is a restricted variety of CPAs to go around, so you might have a tough time locating one particularly if you have actually waited up until the eleventh hour.

CPAs are the" large weapons "of the audit market and typically do not take care of everyday audit jobs. Often, these various other kinds of accounting professionals have specializeds throughout areas where having a CPA certificate isn't needed, such as administration accounting, not-for-profit accountancy, expense bookkeeping, government accounting, or audit. As a result, making use of an accounting solutions business is commonly a far much better value than working with a CERTIFIED PUBLIC ACCOUNTANT

firm to support your sustain financial recurring economicAdministration

Certified public accountants additionally have know-how in creating and improving organizational plans and treatments and analysis of the functional requirements of staffing versions. A well-connected CPA can utilize their network to help the organization in different calculated and consulting roles, efficiently connecting the company to the suitable candidate to fulfill their demands. Following time you're looking to fill a board seat, take into consideration getting Visit Website to out to a CPA that can bring worth to your company in all the methods noted above.

Michael Bower Then & Now!

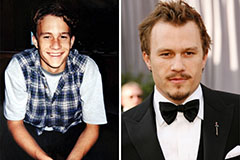

Michael Bower Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!